Bankrupt cryptocurrency lending platform Voyager Digital's native coin voyager (VGX) has more than tripled in three days. According to one observer, the move appears to be driven by a short squeeze.

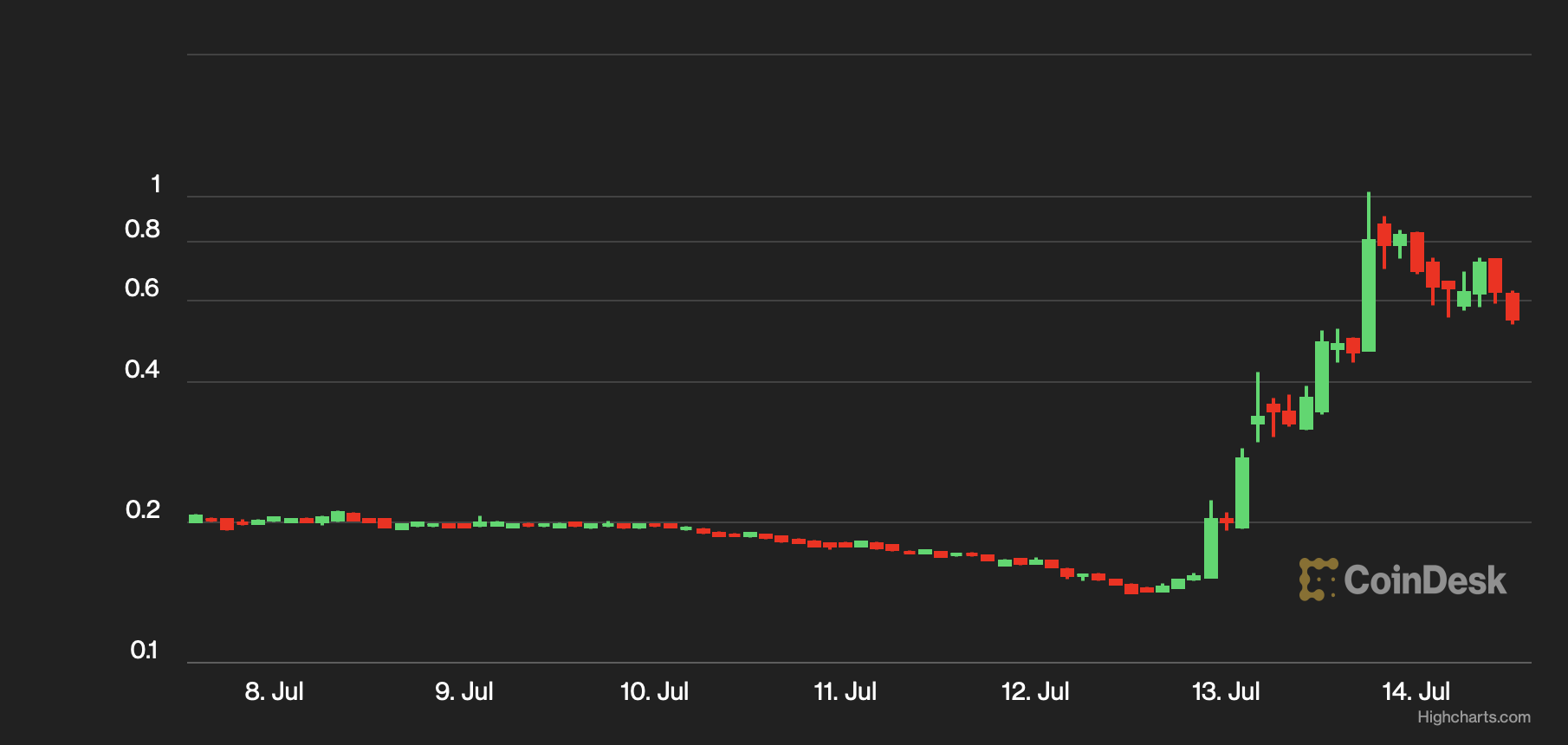

Since Tuesday, VGX has increased by 257% from $0.14 to $0.50 with prices hitting a high of $1.01 in the past 24 hours, CoinDesk data shows.

"Pumping coins of insolvent businesses seem to be becoming a meta," CK Cheung, investment analyst at Defiance Capital, said. "Similar pumps happened to Terra's LUNC token and Celsius' CEL token, mostly because of a short squeeze."

A short squeeze refers to a sharp rally fueled by the unwinding of bearish positions or sellers rushing to take profits. Assets like VGX, that are in a prolonged downtrend marked by extremely bearish investor sentiment, are typically prone to a short squeezes. When an asset is heavily shorted, a minor price bump often has several sellers throw in the towel and square off their sell trades. This, in turn, puts upward pressure on prices, leading to an exaggerated move. The catalyst for an initial move higher can be fundamental news or a prominent trader taking profit on the short position.

VGX hit a record low of $0.14 early this week, registering a 97% decline from the November peak of $5.81. Broader market downturn and concerns about the solvency of crypto companies, particularly lenders, roiled the VGX token in the year's first half. The market fears came true earlier this month, with the Toronto-based lender filing for Chapter 11 bankruptcy protection on July 6, citing the default of the now-insolvent hedge fund Three Arrows Capital (3AC).

On the same day Voyager Digital, whose 60% of the loan book was reportedly composed of loans to 3AC, proposed a restructuring plan, perhaps providing a trigger for the short squeeze.

According to the plan, customers will receive a pro-rata share of four different assets – funds recovered from 3AC, existing VGX tokens, shares in the reorganized firm and other cryptocurrencies.

On Monday, Voyager's CEO Steve Ehrlich clarified that the proposed reorganization is subject to change and the exact amount that the customers will receive would “depend on what happens in the restructuring process and the recovery of 3AC assets.” According to CNBC, a federal judge in the New York bankruptcy court has frozen 3AC's assets.

Further, a VGX pump scheme announced on Twitter by an unknown firm called MetaForm Labs may have powered the rally in the battered cryptocurrency.

Under the "PumpVGXJuly18" plan, MetaForm Labs is targeting a price level of $5, which amounts to an eight-fold rally from the current price of $0.6. That's an ambitious goal considering Voyager's problems. Besides, crypto pump schemes have a bad reputation for being exit strategies for whales and scammers and trapping retail investors on the wrong side of the market.

DISCLOSURE

Please note that our privacy policy, terms of use, cookies, and do not sell my personal information has been updated.

The leader in news and information on cryptocurrency, digital assets and the future of money, CoinDesk is a media outlet that strives for the highest journalistic standards and abides by a strict set of editorial policies. CoinDesk is an independent operating subsidiary of Digital Currency Group, which invests in cryptocurrencies and blockchain startups. As part of their compensation, certain CoinDesk employees, including editorial employees, may receive exposure to DCG equity in the form of stock appreciation rights, which vest over a multi-year period. CoinDesk journalists are not allowed to purchase stock outright in DCG.

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/4VEAPUGMQJBSJAMAAD7UADPDTQ.jpg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/RFIVNCFNANGSVCBTM3ZJZDTIQE.jpeg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/LWJ3MUD5UFDRVLTLGBDJNKQIVM.jpeg)

:quality(70)/cloudfront-us-east-1.images.arcpublishing.com/coindesk/JO37HFK7CBGA7IRKS2OFYVXEK4.jpg)